Credit Card Payment Calculator

Calculate how long it will take to pay off your credit card and how much interest you’ll pay

Enter Your Details

Your Results

Enter your credit card details and click “Calculate” to see your payment plan.

Time to Pay Off

—

Total Interest

—

Payment Summary

Credit Card Payment Calculator: Your Smart Tool for Debt Management

Managing credit card debt can be challenging, especially when interest rates are high and minimum payments barely dent the balance. A Credit Card Payment Calculator simplifies this process by helping you understand exactly how much you need to pay—and for how long—to clear your debt efficiently.

💳 What is a Credit Card Payment Calculator?

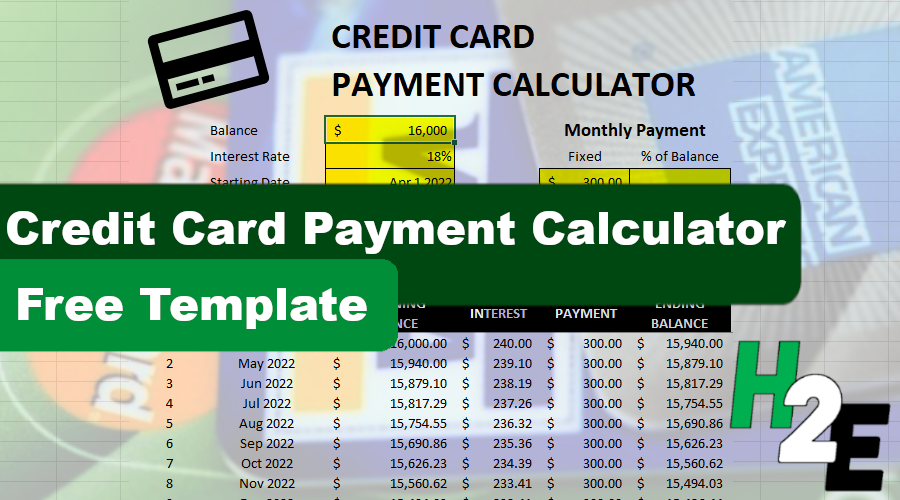

A Credit Card Payment Calculator is an online financial tool that estimates your monthly payments based on key inputs like your current balance, interest rate (APR), and desired payoff timeline. It allows you to experiment with different payment strategies and see the total interest you'll pay under each one.

🧮 How the Calculator Works

To get accurate results, you'll typically enter:

- Current Balance: The total amount you owe on your credit card.

- Annual Percentage Rate (APR): Your card’s interest rate.

- Minimum Payment or a custom monthly payment.

- Optional: Desired payoff period (in months or years).

The calculator will then show:

- Estimated monthly payment

- Total interest paid over time

- Time required to pay off the debt

- How increasing payments reduces interest and shortens your payoff period

Learn more about how credit card interest works from the Consumer Financial Protection Bureau (CFPB).

✅ Key Benefits of Using a Credit Card Payoff Calculator

1. Visualize Your Debt Payoff Timeline

Knowing exactly how long it will take to pay off your debt helps you set realistic goals and stay motivated.

2. See the Impact of Higher Payments

Even a small increase in your monthly payment can significantly reduce the total interest you pay and the time it takes to become debt-free.

3. Compare Different Repayment Strategies

Evaluate multiple repayment plans, such as:

- Paying just the minimum

- Fixed monthly payments

- Snowball or avalanche method (if managing multiple debts)

4. Make Smarter Financial Decisions

By seeing the full picture of your credit card debt, you can make informed decisions about budgeting, saving, or considering balance transfers or consolidation.

📊 Real-Life Use Case Example

Let’s say you have a $5,000 balance at a 20% APR. If you only pay the minimum of $100/month, it could take you almost 8 years to pay it off, costing you over $4,000 in interest.

But if you increase your payment to $250/month, you could pay it off in just over 2 years and save more than $3,000 in interest!

🛠️ Features to Look for in a Good Credit Card Payment Calculator

- User-friendly interface

- Mobile-friendly design

- Ability to adjust interest rates and payment frequency

- Real-time recalculations as you edit values

- Breakdown of monthly payments, principal, and interest

💡 Expert Tips for Managing Credit Card Debt

- Always aim to pay more than the minimum

- Avoid using cards with high APRs for non-essential purchases

- Set up automatic payments to never miss due dates

- Consider balance transfers to lower your interest rate

- Track your spending and create a realistic monthly budget

🎯 Conclusion

A Credit Card Payment Calculator isn’t just a tool—it’s your roadmap to financial freedom. Whether you’re looking to pay off debt faster, lower your interest burden, or simply stay on top of your finances, using this calculator regularly empowers you to make smarter, more informed choices.

Start calculating now and take control of your credit card debt today!