Compound Interest Calculator

See how your money can grow over time with compound interest

Input Details

Results

Initial Investment

$1,000.00

Total Contributions

$12,000.00

Interest Earned

$7,728.19

Final Balance

$20,728.19

| Year | Balance | Interest | Contributions |

|---|

How Compound Interest Works

Compound interest is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods.

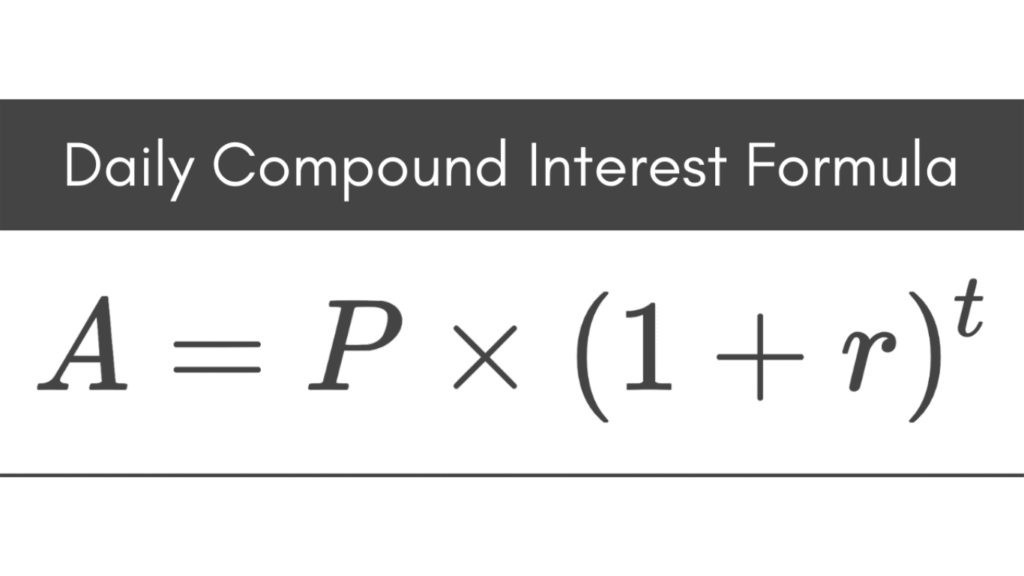

The formula for compound interest is:

A = P × (1 + r/n)nt

Where:

- A = the future value of the investment

- P = the principal investment amount

- r = the annual interest rate (decimal)

- n = the number of times interest is compounded per year

- t = the number of years the money is invested

This calculator also factors in regular monthly contributions to show how consistent investing can significantly increase your returns over time.

Daily Compound Interest Calculator

Daily Compound Interest Calculator is a powerful tool that shows how your money grows every day through the power of compounding. By calculating interest on your principal daily, this calculator helps you understand how small investments can grow significantly over time.

Whether you’re saving, investing, or planning finances, this tool gives you accurate, real-time results to help you make informed decisions.

Daily Compound Interest Calculator is the smartest way to calculate how much your money will grow when interest is compounded every day. It gives you instant and accurate results based on your input — whether you’re saving for the future or investing long-term.

🔍 What Is Daily Compound Interest?

Daily compound interest means interest is calculated and added to your balance every day, not just monthly or annually. This leads to faster and more consistent financial growth over time.

Here’s a quick comparison:

Invest ₹1,00,000 at 10% annual interest for 5 years:

- With Annual Compounding, you earn around ₹61,051.

- With Daily Compounding, your returns grow to about ₹64,872.

That’s nearly ₹3,800 more — just because of daily frequency!

🧮 How the Daily Compound Interest Calculator Works

Our Daily Compound Interest Calculator takes just a few inputs:

- Principal Amount: The starting money you want to invest or save.

- Annual Interest Rate: The yearly rate at which your money earns interest.

- Time Period (in years or months): How long you plan to keep the money invested.

- Daily Compounding: Automatically calculated 365 times a year.

Once you enter the values, the calculator instantly shows:

- Total Interest Earned

- Future Value

- Growth Chart (optional if implemented)

💡 Why Use Daily Compounding?

Using daily compounding helps maximize the returns on:

- High-interest savings accounts

- Fixed deposits

- Investment platforms

- Retirement planning

- Crypto savings accounts

Even a small increase in compounding frequency can mean thousands more over the long run.

For example:

If you invest ₹1,00,000 at 10% annual interest for 5 years…

- Annual Compounding: ₹1,61,051

- Daily Compounding: ₹1,64,872

That’s nearly ₹3,800 more — just by compounding daily.

🔗 Use the Daily Compound Interest Calculator Now

Ready to see your money grow?

Try our free Daily Compound Interest Calculator – no sign-up required, fully mobile-friendly, and instant results.

✅ Key Benefits of Our Calculator

- Free & Easy to Use

- Mobile & Desktop Friendly

- No Login Required

- Instant Calculations

- Great for Students, Investors & Financial Planners

📘 Additional Resources

- Learn more about Compound vs Simple Interest

- Use our Savings Goal Calculator

- Explore our Investment Return Calculator

🧠 Pro Tip: Reinvest Your Interest

To make the most of compound interest, reinvest your earnings rather than withdrawing them. This ensures that the interest also earns interest, creating a snowball effect on your wealth.

📚 Related Tools You Might Like

🚀 Conclusion

A Daily Compound Interest Calculator is not just a financial tool — it’s a wealth-building ally. Whether you’re saving for a big goal or investing for the future, understanding how your money grows daily gives you an edge.