Income Tax Calculator

Calculate your estimated income tax liability for the year

Enter Your Details

Standard deduction applied based on your filing status

Your Tax Results

Total Income

Taxable Income

Tax Breakdown

Effective Tax Rate

Percentage of your total income paid in taxes

Tax Brackets for

| Rate | Range | Tax |

|---|---|---|

| ∞ |

✅ Income Tax Calculator New Regime – Calculate Your Tax Instantly for FY 2025-26

Income Tax Calculator New Regime is the smartest way to estimate your taxes under India’s simplified tax slabs for FY 2025-26. Whether you’re a salaried employee or freelancer, this tool gives you instant results based on the latest rules, standard deductions, and applicable rebates.

✅ Income Tax Calculator New Regime – Calculate Your Tax Instantly

Income Tax Calculator New Regime is your go-to tool for accurately estimating your income tax under the simplified slab system introduced by the Indian government. With the new regime offering lower tax rates but fewer deductions, this calculator helps individuals quickly compute their tax liability for FY 2025-26. Whether you’re a salaried professional, freelancer, or entrepreneur, this tool gives you clarity and control over your finances.

📘 Introduction to the Income Tax Calculator (New Regime)

With the Indian government promoting simplified taxation, many taxpayers are opting for the New Tax Regime. However, calculating tax under this structure can still be confusing without the right tool. That’s where our Income Tax Calculator New Regime helps — it’s fast, accurate, and user-friendly.

Whether you’re a salaried individual, freelancer, or small business owner, this tool makes your tax estimation simple.

📊 Why You Should Use an Income Tax Calculator New Regime Tool in 2025

The Income Tax Calculator New Regime tool gives you accurate results without the need for manual tax computation.

✨ Key Features of New Regime:

- Lower slab rates

- No requirement to submit investment proofs

- Flat tax calculation method

- Standard Deduction of ₹50,000 is now allowed (from FY 2023-24)

🧾 New Regime Slab Rates for FY 2025-26 (AY 2026-27)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

📝 Note: A rebate under Section 87A is applicable if total income is up to ₹7,00,000 (tax becomes zero).

🧮 How to Use the Income Tax Calculator?

Using our Income Tax Calculator for the New Regime is simple:

- Enter your gross annual income

- The calculator applies the standard deduction of ₹50,000 automatically

- Optionally, include other taxable components like bonuses

- Hit Calculate

🔍 The tool will instantly display:

- Taxable income

- Total tax payable

- Effective tax rate

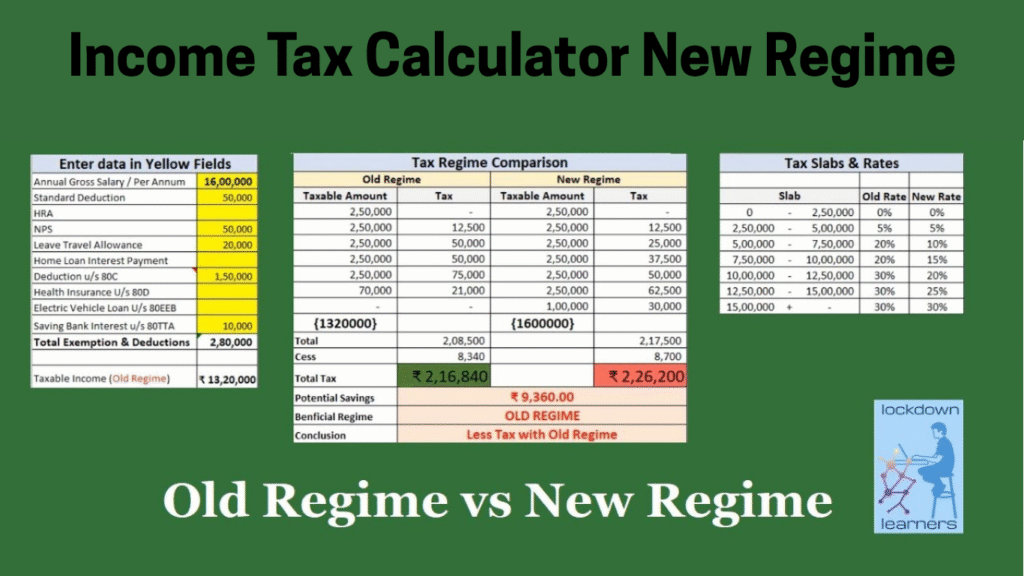

⚖️ Old Regime vs New Regime – What’s Better?

| Criteria | Old Regime | New Regime |

|---|---|---|

| Tax Slabs | Higher | Lower |

| Deductions Allowed | Yes (80C, HRA, etc.) | No (mostly not allowed) |

| Standard Deduction | ₹50,000 | ₹50,000 (from FY 2023-24) |

| Rebate up to ₹7L | May or may not apply | Full rebate for income ≤ ₹7L |

| Best For | High investors, family people | No deductions, simple salary |

💡 Tip: If your deductions exceed ₹3,00,000, the Old Regime may be better.

🧠 Benefits of Using the New Regime Tax Calculator

✅ Up-to-date with latest rules

✅ No manual calculations

✅ Supports standard deduction & rebate

✅ Instant results

✅ Mobile-responsive and secure

📌 Example Calculation:

Income: ₹10,00,000

Tax (New Regime): ₹60,000 (after standard deduction & rebate)

Compared to Old Regime: ₹75,400 (if no 80C deductions)

🔗 Helpful Resources (Add as Outbound Links)

🛠️ Integrate the Tool on Your Website

You can embed this tool easily on your site using HTML + JavaScript. Include dropdowns for:

- Financial Year

- Salary components (Optional)

- Slab comparison (toggle between old vs new regime)

Add social sharing buttons, a print option, and PDF download feature for maximum user value.

📢 Final Thoughts

The Income Tax Calculator (New Regime) is not just a tool — it’s a smart way to make informed financial decisions. As tax policies shift towards simplicity, tools like this become essential for clarity and compliance.